Managing money as a student is not easy. Many students struggle, no matter where or how they’re studying.

However, as a student, you may manage your expenses, including tuition, stationery, program enrollment, online courses, transportation, and debt avoidance, by creating a budget. It’s common to feel overwhelmed by rising expenses.

Even if you have a family fund or a part-time job, expenditures continue to grow. The good news is that students can easily learn how to make a budget.

What You’ll Learn

ToggleWhy Budgeting is Important for Students

Many students think budgeting is just about saving money. However, in fact, it is about how you control finances, such as how much you spend, save, and debt. It doesn’t matter how much you earn. Here are three reasons to understand why.

1. Makes Money Last Longer

Students commonly run out of money before the end of the month.

When they track where their money goes, they will be surprised by how much they might spend on small things like stationery, snacks, or subscriptions.

You can forestall running out of money and spend wisely with the help of a budget.

2. Helps to Avoid Unnecessary Debt

Many students wind themselves up in debt, simply because they don’t keep track of their expenses.

They are taking out loans from relatives and using credit cards excessively to cover costs.

Therefore, budgeting makes it easier to live within your means, reducing the need to borrow.

3. Early Financial Literacy

Early financial literacy is a golden opportunity.

Read Also: What Are Some Common Budgeting Mistakes

Learning it early sets you up for better financial decisions later, like managing earnings, paying bills, or saving for big goals (car, house).

It nurtures habits that will help you long after you graduate from college.

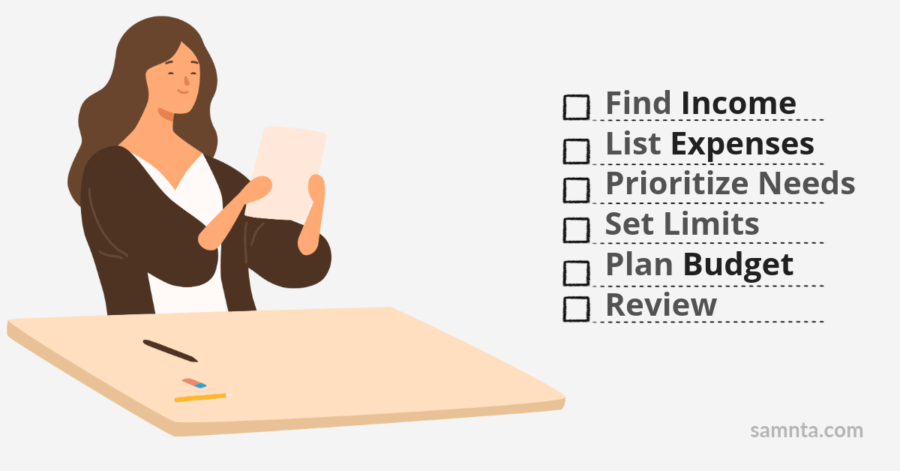

Steps to Create a Student Budget

Step 1: Track Your Income

Many students really think they have enough money only because they have financial aid, a part-time job, or family support.

However, money might fluctuate, and it’s simple to overspend if you don’t keep track of it.

First of all, make a list of every source of money you receive, such as family support, part-time job, scholarships, student loans, or even freelance work.

After that, use a notebook, spreadsheet, or apps to track money.

Normally, if your income varies from month to month, take the average and consider the lowest income for budgeting.

Step 2: List Your Expenses

After calculating how much money you have, the next step is to find where your money is going. Including both fixed and variable expenses.

List of students’ fixed expenses

- Tuition fees

- Rent

- Phone bill

- Transportation pass

- Internet subscription

List of students’ variable expenses that change month to month

- Food and groceries

- Transportation

- School supplies

- Clothing

- Personal items

- Entertainment

- Eating out

- Stationery

- Holidays and trips

Using a notepad, spreadsheet, or app, you may then create a list right after where you calculate income.

Step 3: Prioritize Essentials First

After you’ve made a list of all your spending, it’s important to sort the necessities from the wants. By taking this step, you may ensure that your most basic requirements are met at all times.

The truth is that you have a limited income, which is common for students. You must be extremely frugal with your money.

Make sure all of your requirements are met first. Here are essential expenses (needs), update them accordingly.

- Rent

- Food and Groceries

- Tuition fees

- Transportation

- Phone and internet

- Basic needs

Step 4: Set Spending Limits

You must be aware of your income, costs, and frequency of spending. Setting a limit helps prevent running out of money when you don’t know how much to spend on a certain item.

It’s simple to splurge when there are no limitations, particularly when it comes to entertainment, food, and shopping.

Select the expenses category where you first set the limit, whether it is eating out, entertainment, or transport.

Step 5: Set a Budget

Setting a budget simply means creating a plan for how much money you’ll spend and on what, each month. It has nothing to do with limitations. It has to do with control.

Because you’ve tracked your income, listed your expenses, and prioritized what matters most, it’s time to bring it all together by actually setting your budget.

First, figure out how much you intend to spend. Then deduct it from your net income.

If you have anything left over after subtracting, that’s fantastic! Put the additional money toward emergencies or savings.

If you’re over budget, time to cut back on wants like takeout or subscriptions.

Step 6: Review and Adjust Monthly

One of the most important tasks in budgeting is reviewing and adjusting it regularly.

Because things change in life. You may see changes in your spending patterns or encounter unexpected expenses.

Because of this, you remain adaptable and in charge when you analyze your budget each month.

On your phone, set a monthly reminder. Because it may spare you weeks of financial frustration, it only takes a few minutes.

Conclusion

At first, creating a budget as a student may seem difficult, especially when your income is low and expenses keep coming up.

To take charge of your finances, you don’t have to be a finance expert.

All you need is a straightforward strategy, perseverance, and the flexibility to change the budgeting.

By tracking your income, identifying your expenses, prioritizing your needs, setting spending limits, and evaluating your plan each month.

You may develop good money habits that will benefit you not only as a student but throughout your life.

FAQs

Why is Budgeting Important for Students?

Budgeting allows students to manage their limited income, avoid debt, cover essential expenses such as food and transportation, and gain beneficial financial habits from an early age.

How can a Student Create a Simple Budget?

Starting with tracking your income, analyzing your expenses, prioritizing your needs, setting limitations for each area, and reviewing your budget monthly for improvements.

What are Common Budgeting Mistakes Students make?

Some common mistakes include not tracking expenditures, underestimating spending, ignoring saves, overspending on wants, and failing to review their budget on a regular basis.

Are there Budgeting Tools Students can use without Apps?

Yes, students can budget smoothly with a notebook or spreadsheets.