We all know budgeting, but it can become very challenging when your income is low. I mean feels nearly impossible because you’ve tried budgeting before but get frustrated when unexpected expenses come forward. Perhaps there isn’t always enough money to cover everything..

You’re not alone. There are lots of people who face the daily challenge on a low income to meet basic needs like living, eating, paying off debt, and still trying to save for the future.

The truth is, budgeting on a low income is hard, but it’s also very important. A realistic budget can help you avoid getting into deep financial trouble and build a small emergency fund over time.

What You’ll Learn

ToggleWhy Budgeting on a Low-Income Matters

When you’re earning a low income, sometimes it isn’t enough to cover everything like food, child care, transportation, and medicine.

Without a clear budget plan, it’s difficult to pay bills. After that, people rely on credit for payments and do not have enough money for savings.

For people with low incomes, the following two budget factors are important:

1. Avoid Credit

Low-income earners have many problems; sometimes, they do not have enough money to feed their families.

Here, credit cards come, and people easily get into a credit loop. A simple budgeting method helps to repay debt payments faster.

2. Building Savings

Budgeting helps you prioritize your needs. It gives you more control over your money and can help you build small savings for an emergency fund, retirement, or any future plan.

It does not mean that you must give up all of your hobbies. Instead, it’s about creating a plan, whether you’re working the minimum wage or supporting a family on one income.

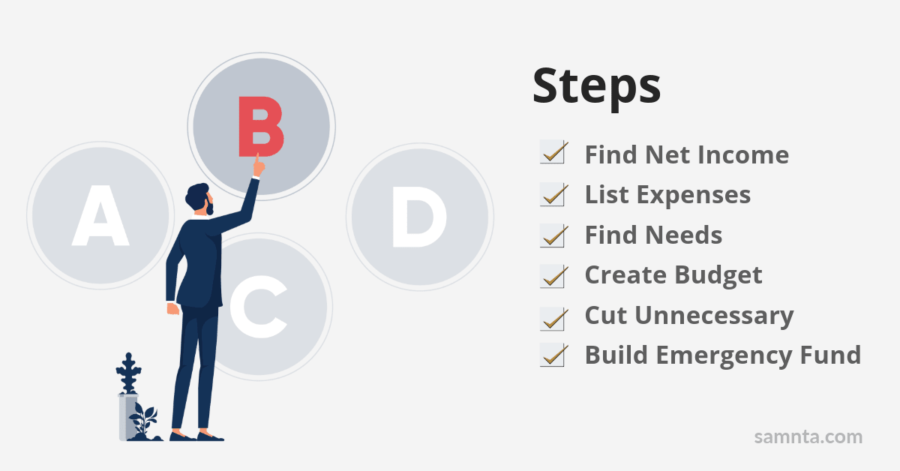

Steps to Budget on a Low-Income

Step 1: Know Your Net Income

Before you can create a budget, you need to know exactly how much money is in your account after tax deduction.

Tax-deducted income is your net income. Many people make mistakes during budgeting, they take gross income (before deductions)

Take the example of Foxx, who earns $5,000 each month, but after taxes or insurance deductions, the money left in the account is $3,800, which is his net income, and $5,000 is his gross income.

Ensure that your budget is based on the net income that you have to spend.

Step 2: Track Every Expense

Once you know how much your net income is, the next step is to find out spending even if it’s too small.

You can track every expense using the previous month’s spending or write down current weekly expenses.

There are mainly two categories, one is fixed expenses like rent, loans, and variable ones groceries, coffee, and online purchases.

When you track every expense, you easily identify the areas where you overspend.

Step 3: Find Out Needs

Now that you’ve tracked your expenses, it’s time to separate needs from wants. This step helps you focus on the most important areas of your budget, that is, your essential needs. Here are the basic expenses required for day‑to‑day living and working:

- Rent

- Utilities (electricity, water, gas)

- Groceries (Food, bread, spices, milk, vegetables)

- Transportation (bus, train)

- Basic healthcare

- Minimum debt payments

Understanding your needs allows you to build a priority-based budget, where the necessary expenses come first. This is especially very important because you have a low income.

Step 4: Create Budget Plan

Now that you know your income and which ones are essential expenses. With your income and spending in mind, it’s time to create a budget that works for you.

Your budget starts with the must-have categories like rent, food, bills, savings, and debt.

You can start with a simple spreadsheet, or a notebook, or choose a budgeting method like the 50/30/20 rule.

Step 5: Cut Unnecessary Costs

Once you plan a budget, the next step is to find where you overspend. Then cut back on non-essential expenses to save and repay debt.

Step 6: Build an Emergency Fund

Even if you have low wages, saving money for emergencies is one of the most critical actions you can take for financial security.

An emergency fund is a small nest egg that you may use to cover unforeseen expenditures such as auto repairs, medical bills, or a sudden job loss.

Start with a small amount like $1 to $10 a week, and gradually increase over time.

Step 7: Find an Extra Income Source

If your current income isn’t enough to meet your needs, try to find an extra source of income. Such as:

- Freelance

- Tutoring

- Part-time

- Selling unused items online

- Babysitting, pet sitting, or house cleaning

- Rideshare or delivery services

The additional income source should be sustainable and not burdensome.

Step 8: Review and Adjust

Creating a budget is not a victory. Many budget plans fail because they aren’t reviewed and updated on a regular basis.

Sometimes bills go up, earnings fluctuate, and emergencies arise. That’s why it’s important to review and update at least once every week.

If something does not work, don’t worry; simply modify it. A budget needs time to work better.

Conclusion

Budgeting on a low income might be difficult at first. Understanding your income, tracking every spending, and prioritizing your requirements will help you establish a solid financial future, no matter how small your starting point.

Even small changes, such as cutting one unneeded cost or saving a few dollars each week, can result in major improvements over time. And if you ever get stuck, go back over your budget, make changes, and keep going.

FAQs

How do I start Budgeting if I have a Low Income?

Start by calculating your net income, i.e., the tax-deductible amount, then list all expenses, find necessities, and choose or create a budget plan.

Is it really possible to Save Money on a Low Income?

Yes, it is possible to save, but the condition is that one should start with a small amount.

What is the best Budgeting Method for Low Income?

For low-income individuals, you can use the 50/30/20 rule and a zero-based budget.

Why is Budgeting Important for Low-income Earners?

Budgeting helps you avoid debt and build savings.