A budgeting system describes how you handle your money. Everyone has different financial goals. For instance, some want to save more, while others aim to live a better lifestyle.

With so many budgeting systems available, it might be challenging to build a budget that meets your goals. As a result, many people use budgeting systems that don’t fit their financial priorities.

That’s why it’s essential to choose a budgeting system that fits your lifestyle. No matter which type you choose, every effective budget has these categories: income, expenses, and savings.

What You’ll Learn

Toggle5 Types of Budgeting Systems

Many budget systems have become more popular since the 18th century, largely due to the rapid growth of economists and financial advisors. Those budget systems have proven effective, so people have started trusting them. Here are the most popular budgeting systems:

1. 50/30/20 Rule

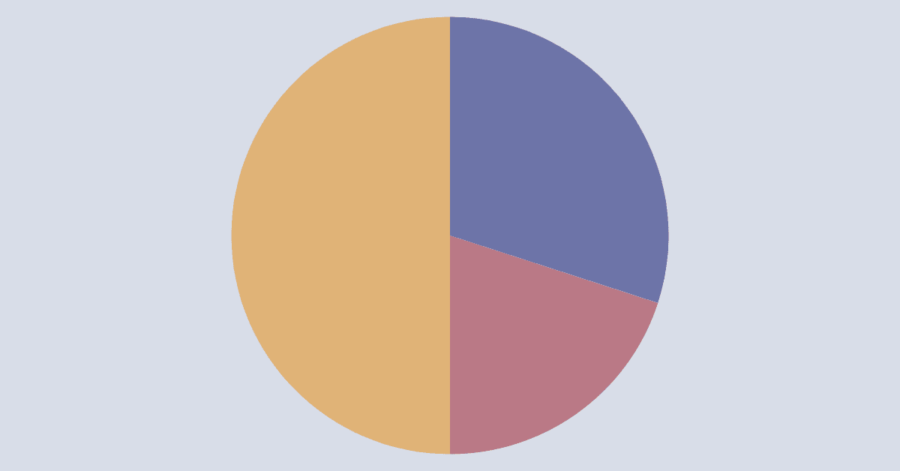

The 50/30/20 rule divides after-tax income into 50% on needs, 30% on wants, and saves or pays off debt with the remaining 20%.

50% Needs: These are necessary expenses, such as rent or mortgage, utilities, food, transportation, and medications.

30% Wants: These cover non-essential purchases that enhance your lifestyle, including eating out, entertainment, hobbies, shopping, subscriptions, and trips.

20% Savings or Debt Repayment: This portion is for building your financial future. It includes savings, investments, emergency funds, and paying off debt.

The 50/30/20 rule is best for beginners and those looking for a simple strategy to start managing money. without diving into complex spreadsheets or detailed tracking.

Before you choose the 50/30/20 rule, read it in detail with the categories. This budget is very easy, and it balances needs with future goals.

2. Zero-Based Budgeting

In this method, you start from zero each month, creating a new budget from scratch to plan your income allocation.

Zero-based budget focuses on necessary expenses like rent, groceries, food, utilities, and even savings.

Recommended: What is Zero-Based Budgeting?

This method is best for those who want full control over their money and, in particular, who are comfortable tracking expenses regularly.

This method works well when you have a tight budget or savings goals.

3. Cash Envelope System

The cash envelope system is where you allocate money into envelopes. It is a simple way to manage your money without overspending.

This method is best for those people who struggle with overspending or those who prefer not to use cards or apps.

Recommended: What is the Cash Envelope System?

You need cash for this budgeting system. And allocate to each category envelopes like rent, groceries, utilities, savings, emergency fund, entertainment, travel, or medicine.

4. Pay Yourself First

Pay Yourself First is where your first priority is to save money instead of spending. This method focuses on saving more money.

When you receive income, you set aside a portion, like 20% or more, for an emergency fund, retirement, investment, or debt repayment.

Recommended: What is Pay Yourself First?

This method is best for those who struggle to save money. It builds saving habits and reduces spending temptation.

5. Kakeibo Budgeting

Kakeibo is a traditional Japanese budgeting system that helps you save money by writing down what you earn, what you spend, and how you plan to save.

Recommended: What is Kakeibo Budget?

You allocate earnings to necessary expenses, optional expenses, culture, and unexpected expenses.

This method is best for those who prefer pen-and-paper journaling and want more control over the money they earn.

How to Choose the Right Budget System

There are many budgeting systems available, and it can be difficult to choose the right one at first. However, the best system for your budget depends on your income type and financial goals, whether it is to build an emergency fund, retirement planning, buy a house, or even investment planning.

Here are some factors to consider when choosing a budget:

1. Financial Goals

Financial goals vary from person to person. But find out what your goals whether it is trying to save for a big purchase, pay off debt, or simply gain control of your spending.

For savings goals, the Pay Yourself First or Kakeibo works well. And Zero-Based Budgeting helps to pay off debt.

2. Personality Type

Know your personality by finding out which type of budget, like simple, structured, detailed, digital, or pan-paper.

For detail-oriented try, Zero-Based Budget, for simple or beginners try the 50/30/20 Rule, and for mindful try Kakeibo budget.

3. Spending Habits

Find out how much you spend, or rely heavily on credit. Overspending is too common among many people. But choosing the right budget helps to reduce overspending.

Therefore, if you tend to overspend, try the Cash Envelope System. Also, pay yourself first to keep your spending in scrutinize and save more money.

4. Earning Potential

Earnings vary from person to person. Someone earns more than the average. To find your earning, first know your earnings type: is it regular or variable, along with income fluctuations.

Overall flexible budgeting system is the 50/30/20 rule.

5. Stubbornness

This is the real factor you can consider during budgeting. How much appetite for financial goals? Stubbornness has many forms, like reviewing regularly, tracking every spending, even if it is small.

For high involvement, try the Zero-Based Budgeting or the Kakeibo budget.

Mistakes When Choosing a Budgeting System

Choosing the right budgeting system is a big step toward a financial journey; a wrong pick creates problems like frustration and gives up. Avoiding these common mistakes can help you find the right method.

1. Follow Trending

Don’t pick a budget based on popularity or recommended by a famous personality. A budget is best when you know your earnings, spending, and saving goals. Then consider not what everyone else is doing.

2. Ignoring Personality Type

If you hate tracking every expense, a method like zero-based budgeting might burn you out. Similarly, if you hate writing, a perfect system like the Kakeibo might feel too vague. Choose a method for how your brain functions in different instances.

3. Switching Too Often

Many people switch the budget system after a week. Every system takes time to learn and adjust accordingly; give yourself at least one month to evaluate.

4. Overcomplicating the Process

Many people start a budget with multiple apps or spreadsheets, and after some time, they feel overwhelmed.

Just think, you have a hundred coins and the task is you put them in your pocket. I think you put one by one, but the twist is that can you put all in one time?

Obviously no. So, how do multiple apps help you during budgeting?

Keep it simple by choosing one with consistency.

5. Not Reviewing

No matter what method you choose, failing to regularly check your budget can make it useless. Make time to review what worked and what didn’t.

Conclusion

There’s no one way to manage your money that will meet all needs. The best budgeting system is the one that fits your goals, lifestyle, and mindset.

Whether you prefer the structure of zero-based budgeting, the simplicity of the 50/30/20 rule, or the mindfulness of Kakeibo, the most important thing is to choose a system you’ll stick with.

Start by understanding your financial priorities, try out a method that aligns with your habits, and don’t be afraid to make adjustments along the way. Budgeting isn’t about restriction—it’s about giving your money a purpose.

With the right budgeting system, you can take control of your finances and get a new lease on life.