Budgeting might be overwhelming, especially if you’re new. But anyone can create a budget, even from scratch. It doesn’t matter when you are living paycheck to paycheck. Learn how to start a budget from zero is like buying a coffee, yes, it’s true. According to a 2023 survey by Debt.com, 85% of people who use a budget say it helps them stay on track financially. Yet, roughly 22% of people maintain a monthly budget.

What You’ll Learn

ToggleWhy Budgeting Matters

Budgeting is the best step you can take to improve your financial journey. Without budgeting, it’s ok to struggle with money.

Look, starting with the budget gives a clear picture of how your income flows, instead of figuring out where your money goes each month.

When you start a budget and stick to maintain, you get control of your finances. Including where you spend, how much you save, and how much you invest.

Even if you think you’re bad with money, starting a budget can change that. It’s not about being perfect, it’s about being prepared.

Read Also: How to Start Investing With $50

Understand Your Money Flow

Before you start a budget, you need to know exactly how much money you have and how much you spend, in short, what is your net income and expenses. Look, income and expenses are the base of every budget.

Read Also: How to Budget Money Step-by-Step

Get ready to note down all your income sources like regular job salary, side gig income, including freelancing, YouTube, blog, and affiliate programs.

Next, note down all your expenses, but break them into two categories: fixed or variable.

Fixed Expenses do not change every month, like Rent or mortgage, Car payments, Insurance, and Subscriptions.

Variable Expenses change every month, like Groceries, Gas, Dining out, Entertainment, Shopping, car maintenance, and holiday gifts.

After getting a rough idea of income and expenses, you can try the budget calculator.

Choose a Budgeting Method

Now that you know how much money you earn and spend, it’s time to choose a budgeting method that fits your lifestyle.

Look, if you don’t know which one suits for finances. Try all methods and get comfortable with one of these.

Pick it as your budgeting method. Here is the list of popular budgeting methods:

1. The 50/30/20 Rule

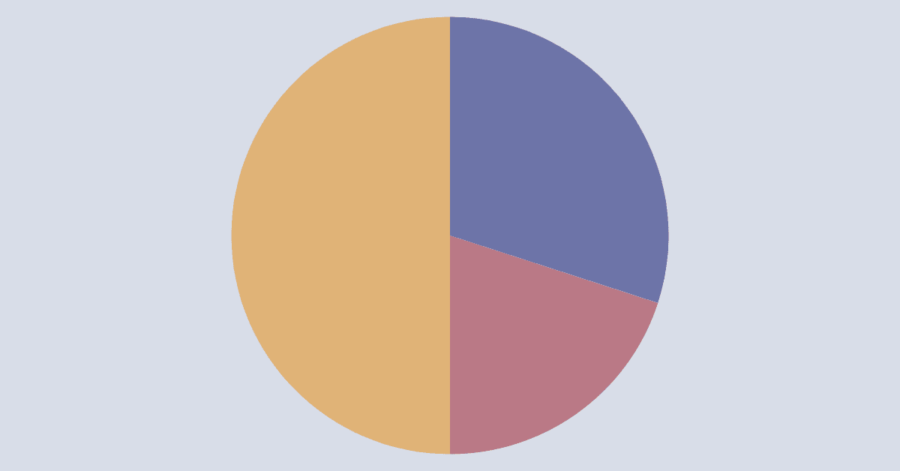

The 50/30/20 budgeting method is very easy to handle your finances. In simple this rule divides your earnings into three parts:

• 50% for Needs: these are must-requirements like rent, mortgage, groceries, utilities, and transportation.

• 30% for Wants: these are common requirements like hobbies, shopping, travel, subscriptions, and eating out.

• 20% for Savings: these are hidden, but supportive, just as bone marrow. Savings including emergency fund, investing, retirement savings like 401k, IRA.

2. Zero-Based Budgeting

This budgeting method includes every penny. In simple terms, in the month end your income and expenses should equal zero.

That doesn’t mean you spend everything. It means you plan for every dollar, including savings. This is best for those who like detailed budget planning.

3. Envelope System

This is a cash-based, older method. You buy envelopes for each category to divide your money.

The crazy part is that when an envelope is empty, you stop spending in that category. It helps you avoid overspending habits.

4. Usual Budget

This budgeting method is usually on a weekly or monthly basis. You categorized them into your income, expenses, debt, and savings.

This is the safest method for those who have privacy concerns. You can track using Notepad or a spreadsheet.

Make Your First Budget

Now you know how much you earn, where your money goes, and budgeting methods. It’s time to build your first budget. Here is the step-by-step actionable budget plan:

Step 1. Start With Your Income

List all sources of income, including salary, side gigs, and any steady income. After that, add it. You got the total income.

Step 2. Categorize Your Expenses

List out all your expenses and break them into simple categories like rent, groceries, utilities, transportation, bills, subscriptions, and debt payment.

Go through each expense category and decide how much you’ll spend. Remember, if you find a category where you cut back spending, then it helps you a lot. After that, add it. You got the total expense.

Step 3: Plan your Savings

Plan how much you save for these categories, including investing, emergency fund, and retirement. After that, add it, and you get the expected total savings for the future.

Step 4. Do the Simple Math

Now subtract your total expenses and total savings from your total income. Congrats, you got the remaining balance. Assign it to savings, debt, or extra spending.

Step 5. Maintain Your Budget

Creating a budget is just the beginning; the main part is maintaining it. You can easily maintain your budget by reviewing it weekly, tracking every expense, including extra spending. Adjusting when needed, in a simple way, making it flexible.

Common Budgeting Mistakes to Avoid

Most people create a solid budget, but ignoring mistakes can slow down financial life. Here is the list of common mistakes to avoid:

Underestimating Irregular Expenses

Some expenses don’t show, like car repairs or gifts. If you don’t plan for these, they can break your budget. Try to add an extra surprise expense category.

Forgetting Annual Fees

Streaming services or even some memberships are often annual basis, and this is easy to forget. So, add them to your budget by dividing the total cost over 12 months.

Easily Giving Up

Look, budgeting takes time. Many people give up due to one bad month. Remember, consistent effort makes you stronger for an unexpected emergency, or even to buy your dream house/car.

Conclusion

Starting a budget from scratch might feel overwhelming, but it doesn’t have to be. But the only matter is getting started. When you understand income, expense, and savings, choose a budgeting method that fits your life and enjoy your dreams. Remember, your first budget won’t be perfect. That’s okay. Look, you’ll learn, adjust, and improve with time. Stay consistent, check in weekly, and don’t give up after a setback.