The majority of people don’t follow a budget. Studies show that less than 40% of people follow a personal finance plan to manage their money. Surprisingly, a budget plan helps, whether you’re saving for a home or just investing money. However, many people still struggling to manage their finances.

What You’ll Learn

ToggleWhat Is a Budget?

A budget outlines how you plan to divide your income or resources to cover your expenses and needs within a set timeframe.

The word “budget” basically comes from the French word “bougette”. That simple meaning is a leather bag. But the old Latin people also used the word “Bulge“, that similar to the French word meaning.

The simple definition of a budget is a plan for how to earn, spend, and save money.

Read Also: How To Start A Budget From Scratch

Why Is Budgeting Important?

Budgeting is important because it gives full control of how finances are used.

Without a financial plan, it is very common to run out of money. Even most people are struggling to control their spendings.

It helps you make better choices. When you know what you have and what you need, it’s easier to decide where to spend or focus on first.

When you have a clear plan, you don’t have to constantly worry about running into financial problems.

You know, creating a budget helps you to reach your goals fast. Even if you’re saving, investing, or managing.

Overall, a personal finance plan is very important to achieving financial goals, whether it is buying a house, a new car, a dream vacation, gadgets, or clothes that you like to purchase.

Read More: How To Budget Money Step By Step

What Should Be in a Budget?

The budget has included income, expenses, and savings/debt, which are the pillars.

To get better results, use after-tax income, because it defines what money you actually have in your account.

Include all sources of income, whether it is a paycheck, freelancing, gig work, gifts, bonuses, blogging, or even YouTube earnings.

There are a lot of expenditures. But major expenses are essential or non-essential. Essential expenses are fixed, like rent/mortgage, groceries, utilities, medications, bills, or transportation.

Non-essential expenses are anything where money is spent, like daily coffee shop visits, dining out, frequent vacations, subscriptions, buying the latest gadgets, and excessive shopping.

While planning a financial plan, savings are ignored just like the sound of chewing while eating. This is funny, but that’s true.

So, savings are very important. We don’t know when the emergency will knock on the door. Savings have many types, like saving in a high-yield savings account, in the form of an emergency fund, or a plan for retirement.

Along with savings, don’t forget to repay debt. The debt has many forms, like credit card bills, education loans, house loans, or even car loans.

How To Start a Budget

Starting a spending plan requires a proper strategy that justifies your needs and manages wants. Here is the step-by-step guide to start with a personal finance plan:

Step 1: Understand Requirements

Requirements are of two types, needs and wants. It may be confusing or similar, but the common difference is that needs are necessary requirements, and wants are unnecessary requirements.

When you resist wants, you find out the power of Restraint.

Step 2: Calculate Earnings

Calculate all income after taxes are deducted. Sums up all earnings from various income sources.

That is net income, write it down on a blank paper or a notepad.

Step 3: Track Spending

Track your spending, including what’s necessary for you and what’s not. Sums up all expenditures.

Step 4: Pick a Financial Plan

Start with a personal finance plan using a blank sheet or a notepad. First time does not look good, but it works better.

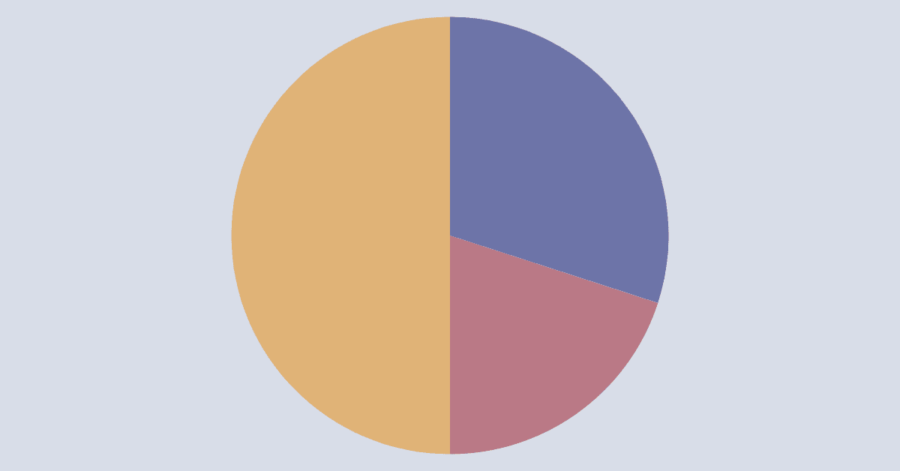

Make sure the spending plan is monthly basis or has one of these: the 50/30/20 budget, zero-based budget, cash envelope system, and a simple budget that fulfills your requirements.

You pick budget spreadsheets or applications. That provided a structured plan for better money management.

Common Budgeting Mistakes

Starting a budget creates a lot of mistakes, but ignoring it creates more problems. Here are the common budgeting mistakes to avoid:

1. Forgetting Small Expenses

We often forget to add small expenses. It’s one of the most frequent mistakes in the budgeting process.

2. Being Too Strict

A budget is flexible. Being too strict on a budget fails after some time. Avoid this mistake while making a spending plan.

3. Not Reviewing Regularly

Life changes every second, so why do we expect a budget without updates to work well? Reviewing a budget regularly and updating it.

This mistake leads to major problems like stress, frustration, or even financial instability.

Conclusion

Think of a budget as a money map – it shows what you earn, where it’s going, and what’s left to save, to make better financial decisions.

By understanding what a budget is and why it matters, you empower yourself to take control of your financial future.

And easily master how to start a financial plan. Don’t do it perfectly; start with the basics.

FAQs

What is Budget Meaning in Personal Finance?

A budget is simple plan that describe how you handle expenditure and saving with earnings.