Managing personal finances can be a stressful experience in today’s world. With so many budgeting methods available, it’s easy to feel confused. That’s why most families and individuals choose the 50/30/20 budgeting rule: it’s straightforward to follow. It categorizes your income into three simple groups – needs, wants, and savings – making money management much more manageable.

What You’ll Learn

Toggle50/30/20 Budget Rule

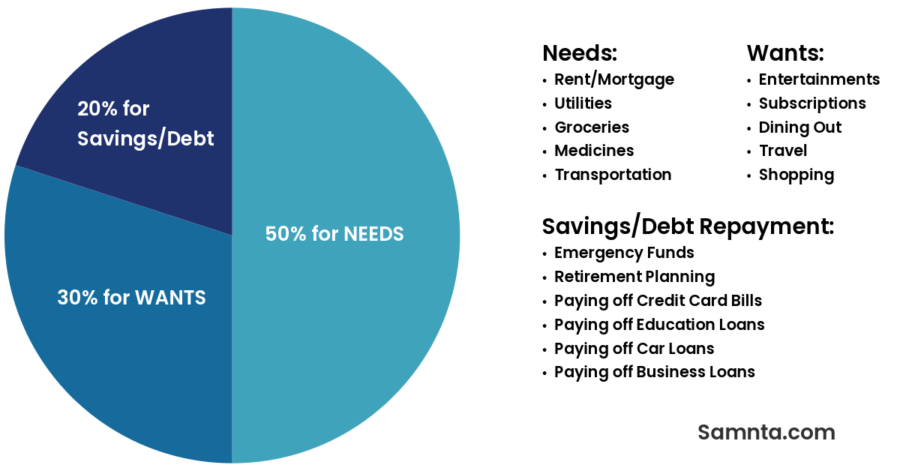

Definition: The 50/30/20 rule is a simple budgeting method that divides earnings after tax into 50% on needs, 30% on wants, and saves or pays off debt with the remaining 20%.

Origin of the Concept: The 50/30/20 rule was introduced by Senator Elizabeth Warren, a Harvard bankruptcy expert. This method was designed to offer a balanced approach to budgeting.

Example: Czr’s monthly earnings are around $20k. He uses the 50/30/20 Rule to divide his income.

Read Also: How to Start a Budget from Scratch

He spent 50% on needs, around $10k. 30% on wants, around $6k. And 20% on savings or repaying debt, around $4k.

What Are the 50/30/20 Budget Categories?

The 50/30/20 Budget has three major categories. Those are needs, wants, and savings/debt.

(1) 50% Needs

Everyone has different needs. First of all, find what is really necessary for you. Needs are essential expenditures. Here are the common needs:

- Rent/mortgage

- Utilities

- Groceries

- Insurance

- Transportation

- Medicines

- Others (in your case)

(2) 30% Wants

You are always confused between wants and needs; sometimes, there is a minor difference. So, wants are non-essential expenditures. That may be required, but not necessary. Here are the common wants:

- Dining out

- Entertainment

- Travel Destination

- Subscriptions

- Latest Gadgets

- Online Shopping

- Big house

- Luxury Car

- Membership in Elite Clubs

- Others (in your case)

(3) 20% Savings and Debt Repayment

Savings are necessary, but it’s ignored as Terms & conditions when signing up. So, savings and paying off debt are like the backbone; we still survive without anything.

Recommended: How To Save Money Fast On A Low-Income

Here are the most common categories:

- Emergency fund

- Retirement accounts (401(k), IRA)

- Paying off the credit card bills

- Paying off student loans

- Paying off car loans

- Others (in your case)

How Does The 50/30/20 Budgeting Rule Work?

The 50-30-20 budget plan works simply. Look, you have money that is 100%, this rule is divided into the ratios 5:3:2.

503020 Budget focus: What are your needs that are essential for you, and what are your wants? And the best part is, it gives 20% to save money and debt repayment.

In today’s world, we all run in a blind race called “Invest your money”. Doing investing is very good, but without saving, it’s just like crossing the busy road with closed eyes.

This budget helps you to save money, not your whole income, only 20%. And create a difference between needs and wants.

How to Calculate 50/30/20 Budget?

Implementing the 50/30/20 rule is very simple. So, here is the step-by-step guide:

Step 1. Calculate your after-tax income

Find out all income sources, including salary income, side gigs, freelancing, and sold items.

Sums up all after tax deductions, then you get the total net income. This net income is 100%.

Step 2. Categorize your current expenses

Find out all expenses, including minor ones. Write all expenses on white paper or a digital notepad.

Divide into two categories: Needs and Wants. If you are confused about categorizing needs or wants. Take a deep breath, then find what is needed or what you want.

After that, sub-categorize them. For needs, that are rent/mortgage, utilities, groceries, insurance, transportation, and medicines.

For wants, that are dining out, entertainment, travel, subscriptions, internet, shopping, and memberships.

Step 3. Adjust spending to match the rule

You note down all spending. But you are still confused, where do I get or find the 50/30/20 budgeting rule? I know, don’t worry, you try spreadsheets or applications.

After that, align all of them accordingly to category or subcategory.

Step 4. Find the 50/30/20 Rule

The best way to get the 50/30/20 budget is to use a spreadsheet. Because you customize it to your requirements. There are many applications available, but the interface may be liked or may not.

Common 50/30/20 Budgeting Mistakes

Making mistakes during budgeting is too common, but ignoring them may create stress. Here are the 50/30/20 budget mistakes and how to avoid them:

1. Misclassifying wants as needs

Before creating the 50/30/20 budget, many people can’t find out what their needs or wants.

Look, needs are essential expenses, whether it is rent, mortgage, gas, electricity, medicines, food and groceries, transportation, and others. Except all these are wants.

For a detailed review of the above section, Breaking Down the Categories of the 503020 Rule.

To fix this mistake, try to understand the core difference. If possible, wait 24 hours before spending. This will help you to understand what you really want.

2. Ignoring irregular income or expenses

Irregularity is common, whether it is income or expense. But ignoring is the biggest mistake when you create a budget.

To fix this mistake, try tracking everything. If possible, create an emergency fund.

3. Budgeting Without Tracking

Creating the 50/30/20 budget without knowing real expenses is a big mistake.

Fix this by finding out all expenses.

4. Using Gross Instead of Net Income

Gross income is different from net income. Gross income includes taxes, but net income does without taxes.

To get better results, use net income.

5. Not adjusting over time

Every second we spend becomes past. So, why do you just think you don’t need to upgrade your budget?

This is a too common mistake, to fix, update regularly or weekly to stay on budget. Otherwise, you are just saying budgeting does not work.

Conclusion

The 50/30/20 budgeting rule is a simple and structured approach to your spending.

To gain better control, divide your income into three categories – needs (50%), wants (30%), and savings or debt payments (20%).

If you understand spending and don’t ignore mistakes, this budget helps you to achieve your dream lifestyle, trust me, that’s true.

Try it for one month, track your income, categorize your expenses honestly, and see how it feels. Even small changes can lead to big results.