The cash envelope system is gaining popularity as managing money has never been more challenging than it is today, especially in a world where everything moves fast and it’s easy to spend money quickly. Despite the rise of digital budgeting apps, many people still struggle with overspending and debt.

To regain control, more people are turning to one of the most effective budgeting methods — the cash envelope system.

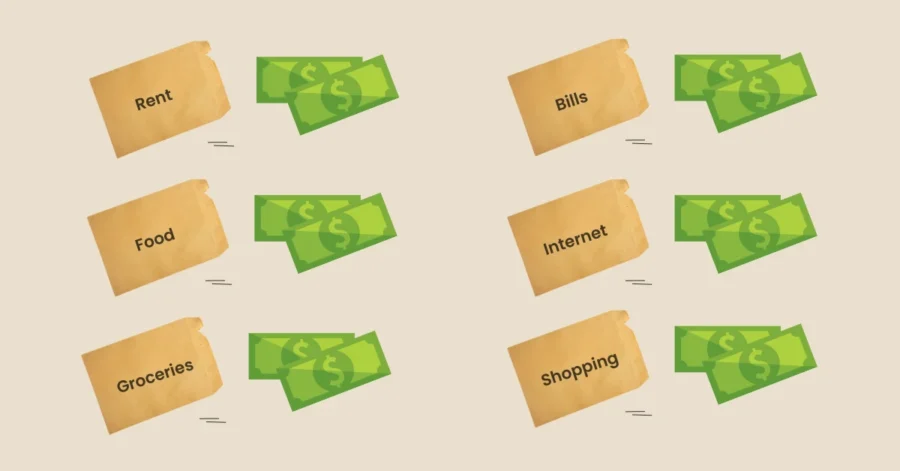

With this budgeting method, you divide your money into envelopes labeled for each spending category. It’s especially helpful for those who are looking to build better financial habits. It’s very simple and highly effective for beginners.

What You’ll Learn

ToggleCash Envelope System

Definition: The cash envelope system is a budgeting method where you allocate money into envelopes based on different spending categories, which helps you avoid overspending.

Origin of the Concept: People have been using the cash envelope system for many years, but it was popularized by financial expert Dave Ramsey. This method was designed to allocate cash to different spending categories using envelopes.

Real-Life Example: Let’s take Zoey, a school teacher with a monthly income of $5,000 after taxes. Her essential expenses, including rent, food, groceries, utilities, and transportation, total $3,800.

To manage her spending, Zoey creates a labeled envelope for each expense category. She then withdraws cash and allocates the appropriate amount to each envelope.

Read Also: What is a Budget

By using the cash envelope budgeting method, Zoey ensures she stays within her spending limits and avoids the temptation to overspend.

How to Start Cash Envelope System

The cash envelope system is a simple way to manage your money without overspending. Here’s how you can set it up and start using cash envelopes step by step:

Step 1. List Monthly Income

Start by finding out how much money you have in your account each month after taxes.

This could include your salary, freelance income, side jobs, or any other sources. For example, Zoey earns $5,000 per month after taxes.

Step 2. Identify Spending Categories

Break your monthly expenses into categories such as:

- Rent or mortgage

- Food and Groceries

- Transportation (gas, public transit)

- Utilities (electricity, internet, water)

- Entertainment

- Miscellaneous

These are common expense categories. Choose those categories where you typically want better control.

Step 3. Assign a Budgeted Amount to Each Category

Decide how much cash to spend in each category for the month based on your income. Prioritize the category based on necessity.

Be sure the total amount you budget doesn’t go over your monthly income. For example, Zoey assigns each category, and her total is $3,800, which does not exceed her monthly income.

Step 4. Prepare Your Envelopes

Grab physical envelopes from the store. After that, label each one with the name of a category: e.g., “Groceries,” “Gas,” “Rent.”

Step 5. Withdraw and Divide Your Cash

Withdraw the total amount of cash you budgeted. Then, divide the cash into the envelopes according to your plan.

Step 6. Spend Only What’s in the Envelope

Each time you spend money, take it from the matching envelope. When an envelope runs out of cash, you can’t spend in that category again until it’s refilled next month.

In an emergency, you withdraw extra cash from another less necessary envelope. Remember, the real budget that works well is flexible, not too strict.

Is the Cash Envelope System Right for You?

There are too many budgeting methods available. However, you find that the cash envelope system is ideal for you by taking the self-test below. Start by asking yourself these three questions.

- Do you overspend often?

- Is cash easier for you to manage than apps?

- Are you living paycheck to paycheck?

If you answered two or more questions, the cash envelope system may be a good fit for you.

Common Cash Envelope Budgeting Mistakes

During cash envelope budgeting, making mistakes is easy, especially when you’re just getting started. These mistakes complicate the budget and make it difficult to manage. Here are some common mistakes to avoid:

1. Not Tracking Spending

Grab the envelope, and stuffing cash in it isn’t enough. You still need to keep track of where it goes.

Sometimes we forget to track small spending, like frequent coffee shop visits. This seems like nothing, but at the end of the month, it creates a big impact.

Therefore, track expenses regularly, even if they are small.

2. Using Too Many Categories

Having too many envelopes can make the budget more confusing. Use the required category for easy management.

If you have too many expense categories, that’s okay, but make sure all the categories are separate.

3. Borrowing from Other Envelopes

Borrowing cash from another envelope to cover overspending is tempting.

When you allocate cash, keep more at that time so that you don’t have to take it out from another envelope later.

4. Not preparing for irregular expenses

When ignoring Irregular expenses messed up the whole budget. The unexpected costs, like car repairs or gifts.

When you create a budget, make sure to add unexpected costs.

Recommended: How To Budget With Irregular Income

5. Switching back to cards too soon

It is very difficult to maintain consistency. Sometimes, when the envelope runs out of cash, it is much easier to switch back to a debit or credit card.

That is a common mistake, but avoiding it becomes more difficult.

Conclusion

The cash envelope system is a simple but powerful way to take control of your spending.

By using physical cash and allocating it to specific categories, you become more aware of your habits. This budgeting method is designed to avoid overspending.

It’s very useful when you’re overspending.

If you’re tired of forgetting where your money goes, try this method for a month and see the results.