Worldwide, millions of people are uncertain about their financial situation. According to surveys, a large percentage of adults consistently struggle with budgeting, saving, or living within their means. For many, it’s not just a matter of how much they earn – it’s about how they manage what they have.

This is where zero-based budgeting (ZBB) is useful in this situation. Now the question is, how is zero-based budgeting different from other traditional budgeting methods?

Rather than relying on past habits, zero-based budgeting puts you in full command of your money by requiring a plan for every cent before the month even begins.

What You’ll Learn

ToggleZero-Based Budgeting

Definition: Zero-based budgeting is a method that starts from zero each month, where instead of relying on a previous budget, you create a new budget from scratch and plan how to use every dollar you earn.

Origin of the Concept: Zero-based budgeting (ZBB) was introduced by Peter Pyhrr, a former Accounting Manager. This method was designed to start everything from scratch.

Example: AXz has a monthly income of $2,000, and she uses ZBB.

She calculated that her total expenses this month are $1,600. But she still has $400 left over. She decided to add the remaining money to her emergency fund.

At the end of the month, she had nothing left because she planned every dollar.

How to Start Zero-Based Budgeting

Zero-based budgeting is based on an easy approach that involves planning every dollar until there is nothing left over – that is, zero left over at the end. Here’s how to do ZBB step by step:

Step 1. Know Your Monthly Income

Write down exactly how much money you earn this month, like salary, side hustle, freelance work, or other sources of income.

Make sure this income has been calculated after tax deductions. Because it clarifies your actual income.

Step 2. List Every Expense

Write down all spending categories. Include a variable or fixed expense.

Fixed expenses, like rent/mortgage, subscriptions, tuition, phone bills, car loans, and insurance.

Variable expenses, like groceries, food, utilities, transport, beauty, medicines, dining out, or shopping.

Step 3. List Savings/Debt Payments

Note how much you save this month for emergency fund, savings, retirement savings, or savings for investments/ future goals.

After that, know how much you repay for all debts, such as credit card bills or loans.

Step 4. Assign Every Penny

Before we start, make sure you note down your income, expenses with categories, and savings/debt.

Start allocating money from your income to each expense category and savings/debt, one by one, until every penny is accounted for.

The goal is Zero. It means planning everything, including debt repayment and savings, rather than spending everything.

Step 5. Choose a Budgeting Tool

You can create your Zero-based budgeting using pen and paper, spreadsheets, and applications. It depends on you which one you feel more comfortable in.

Starting with pen and paper is best, then move to higher approaches like spreadsheets.

Read Also: How To Budget Money Step By Step

How to Find Zero-Based Budgeting is for You?

There are many budgeting methods available. However, you find that zero-based budgeting is ideal for you by taking the self-test below.

Start by asking yourself these three questions.

- Do you struggle to save consistently?

- Do you feel unsure where your money goes?

- Do you reset your budget every time something breaks?

If you give two or more accurate answers, then Zero-Based Budgeting is for you.

Benefits of Zero-Based Budgeting

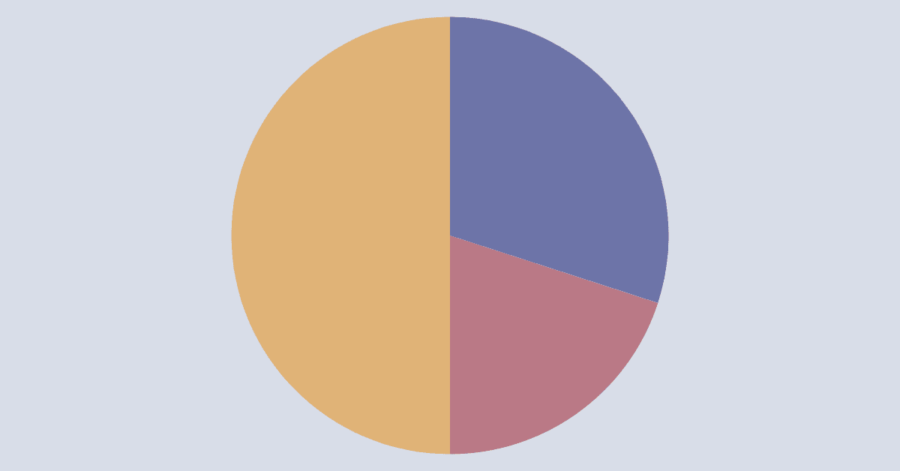

Zero-based budgeting has many benefits. Here we discuss two benefits:

This method is very helpful because it allocates every penny for each expense category. So, the risk ok overspending has become very low.

If your main goals are savings and debt payoff, then this method is great for you.

Because you design it, and if you don’t allocate money for unnecessary expenses, then you leave more money to save.

Common Zero-Based Budgeting Mistakes

It’s too normal to make mistakes while creating a budget, but ignoring them may lead to stress. Here are common mistakes to avoid:

1. Overestimating Income

When creating ZBB, we commonly use total income. Total income is tax-inclusive. And this creates a big error when allocating money. So, use after-tax income.

2. Forgetting Irregular Expenses

Many individuals or families are confused between regular or irregular expenses. They think all expenses are the same.

That’s right, but spending all the money without knowing would be foolishness. Find what is really necessary?

Irregular expenses are dining out, shopping, entertainment, vacations, subscriptions, and memberships.

3. Too Many Categories

When you start a budget, your aim should be keep it simple and have a basic category.

Not too many nor too less. Because it becomes very difficult to manage too many categories.

4. Ignoring Savings or Debt

Zero-based budgeting is like cooking a meal. You can’t skip ingredients and hope it tastes good.

Right? You make an ingredients list, then follow the steps!

So, Savings/Debt is a part of budgeting. You can’t skip it.

Conclusion

Zero-based budgeting helps you take control of your money by planning where every dollar goes. It doesn’t matter how much you earn.

Keep in mind that how you handle it is all that matters.

Instead of repeating old months’ spending, Zero-Based Budgeting lets you start fresh each month.

Share your thoughts in the comments.

Your story might inspire someone else!